1099 Tax Deduction Tool

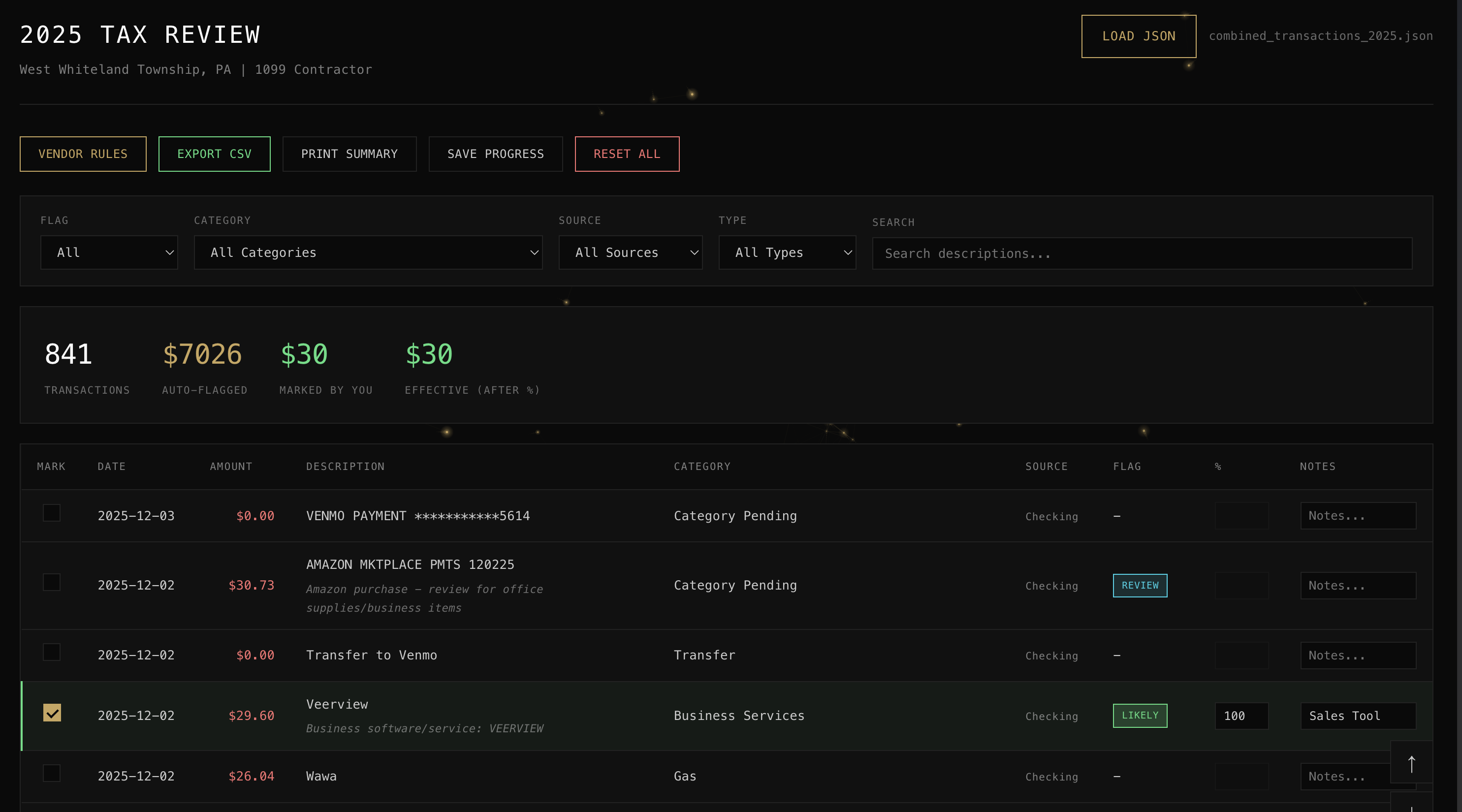

[COMPLETE]A personal finance tool that consolidates bank statements, auto-flags tax-deductible expenses, and provides an interactive browser-based review interface for CPA preparation.

The Problem

As a 1099 contractor, tax time means sifting through thousands of transactions across multiple accounts to find deductible business expenses. My CPA needs a clear list of what I'm claiming and why - but manually reviewing bank statements is tedious and error-prone.

The Solution

I built a two-part system:

- Python consolidation script - Merges CSVs from different banks into a unified format

- Browser-based review tool - Interactive interface to mark and export deductions

Data Pipeline

The consolidation script handles the messiness of different bank formats:

- AMEX Gold: MM/DD/YYYY dates, positive amounts are charges

- USAA Checking: YYYY-MM-DD dates, negative amounts are debits

- USAA Visa Credit: Different column names, mixed transaction types

Everything gets normalized into a standard schema with consistent dates, amounts, and transaction types (expense, income, transfer, fee, refund).

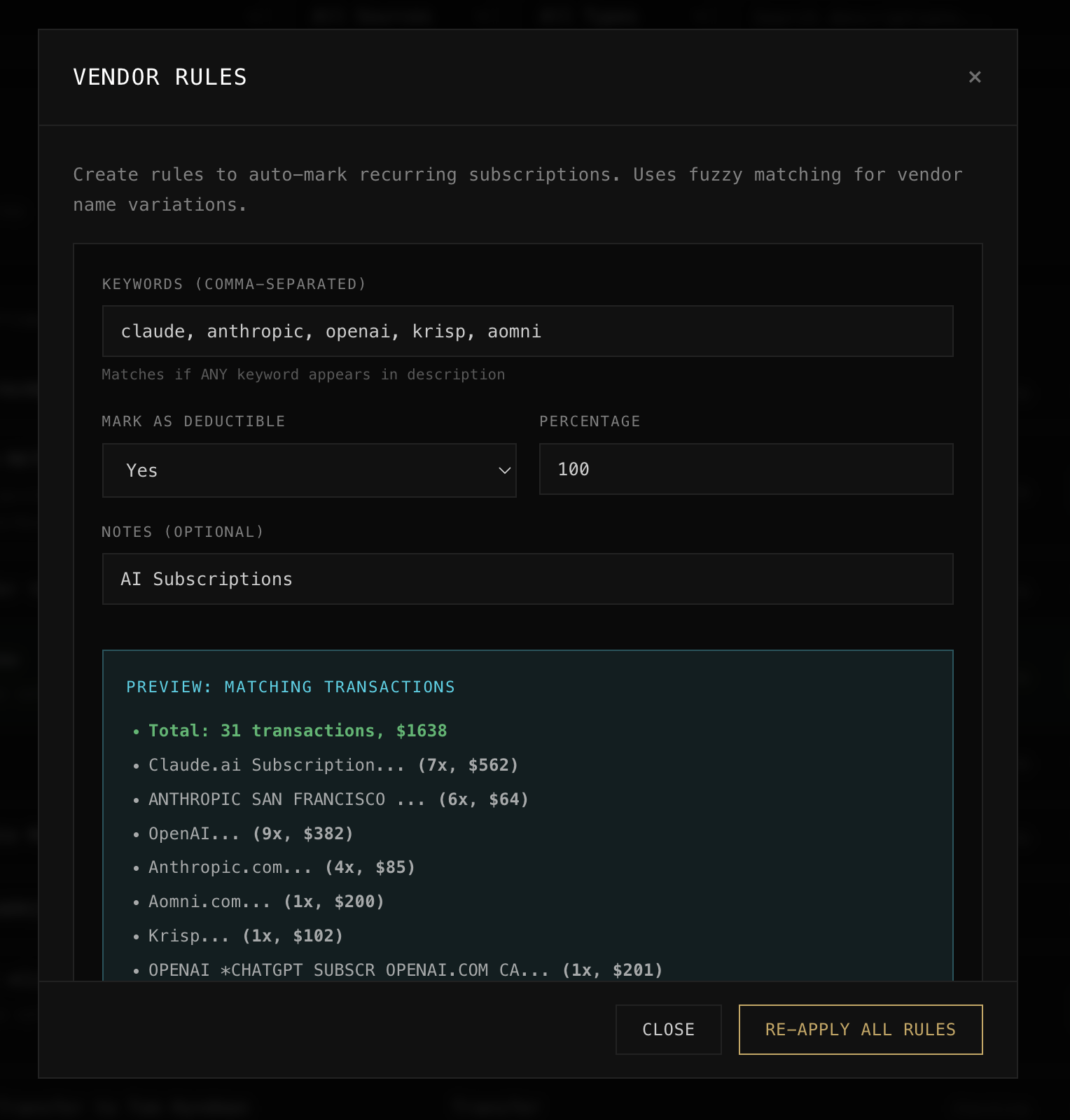

Smart Tax Flagging

The script automatically flags transactions with deduction potential based on:

Merchant matching for business tools I use:

- OpenAI, Anthropic/Claude, Cursor, GitHub, AWS

- Slack, Notion, Linear, Figma

- Domain registrars, hosting services

Category-based rules for:

- Business Services

- Electronics & Software

- Professional Development

- Auto & Transport (for business travel)

Each flag includes a confidence level: likely, possible, or review.

Interactive Review Interface

The HTML tool runs entirely in the browser - no server needed. Just load your JSON file and start reviewing:

Features include:

- Sortable table with all transaction details

- Checkbox system to mark items as deductible

- Percentage selector for partial business use (e.g., 50% of phone bill)

- Fuzzy vendor matching - handles variations like "ANTHROPIC" vs "Claude.ai"

- Real-time stats - total expenses, income, flagged deductions

- LocalStorage persistence - decisions survive browser refresh

- CSV export - formatted for CPA review

The Workflow

- Download CSVs from each bank account

- Run

python process_statements.pyto consolidate - Open

tax_review.htmland load the JSON output - Review auto-flagged items, mark additional deductions

- Export CSV and send to CPA

What used to take hours of spreadsheet work now takes about 30 minutes of focused review.

Technical Notes

- No dependencies for the review tool - single HTML file with vanilla JS

- Deduplication logic - prevents double-counting when transactions appear in multiple exports

- Audit trail - preserves original bank data alongside normalized fields

- ~40+ pre-configured merchants - immediate flagging for common SaaS subscriptions

Privacy First

Everything runs locally. Bank data never leaves my machine - no cloud services, no APIs, no data sharing. The tool is designed for personal use with complete control over sensitive financial information.